Saturday, May 24, 2008

RedDirt's Weekly Update

The BricTrade is hanging in there so far. I moved my trailing stop up to $54 on the EEB and it came very close to taking me out of the trade on Friday. I've been getting some signal's telling me to get the Hell out of the trade but I'll take my emotions out of this and let the trend line do my work. Check out all my BricTrade Charts by clicking HERE!

Here's a LINK to what I'll be reading once again this Memorial Day Holiday. I visit it every year since 1999, just to remind me , "if a horse shoe is hot, it shouldn't take me long to figure it out."

Good luck with your trades and I'll be back in a couple of weeks.

Labels: RedDirts BRIC Trade, technical analysis, weekly update

Sunday, May 18, 2008

RedDirt's Weekly Update

Now on to the business at hand. "Multiple time frames". As you can tell by looking at my Macro to Micro time frame charts for the majors at RedDirtTraderCharts you can see that I've been trading with that mind frame for some time. Although, I never thought to write a book about it like Brian Shannon of alphatrends did. kirkreport.com reviewed the book and had some come-back questions for Mr. Shannon. Looks like he is passing the test. Basically I look at 5 time frames although depending on overall market conditions I may only be trading 3 or 4 of them.

As for what the market will do this week, your guess is as good as mine. Week before last I missed the downside on the SP500 by 7 points with my call of 1377. This past week I totally blew it with my call for another bite by the bear. So, depending on what your time frame was, last week was either good(1 minute,60minute,daily) or bad(weekly, monthly).

What I saw on the 1 minute chart late Friday tells me, I was probably early on my call.

I guess I'll have to order Brian's Book and read it for myself. I'm most interested in what his allocations are for each time frame. The longer time frame=more allocation v. shorter time frame=less allocation would be my guess.

Be sure to click on the links in the left sidebar to see what the latest updates are from the DecisionMoose, RedDirt's BricTrade, and all my other favorites.

Labels: decisionmoose, RedDirts BRIC Trade, technical analysis, weekly update

Saturday, May 17, 2008

Garp Scan Updated

The GarpScan is newly updated. This most recent scan produced a list of 17 stocks. Click Here to see the list. I've decided to stick with my orginal Garp Scan Criteria but the stocks will now be ranked by Price/Sales. The paper I received from William Dirlam at DecisionMoose.com inlightened my thinking of which stocks on my scan may provide the best returns. What to look for on the Garp List. 1)Low price/sales ratio. 2)Low debt ratio.

The GarpScan is newly updated. This most recent scan produced a list of 17 stocks. Click Here to see the list. I've decided to stick with my orginal Garp Scan Criteria but the stocks will now be ranked by Price/Sales. The paper I received from William Dirlam at DecisionMoose.com inlightened my thinking of which stocks on my scan may provide the best returns. What to look for on the Garp List. 1)Low price/sales ratio. 2)Low debt ratio.3)Higher than industry average PE ratio. #3 may be a tough one to obtain before a mark-up phase is taking place.

My thinking leads me to believe the chart will still be the most important tool in successful GarpStocks trading. Case in point, the chart to the left for CVLT. It showed up on my May 4th, 2008 scan. It traded in a very tight range then busted out above the trading band this past week for a very good gain. Click on the chart for a better view. Unfortunately for me I didn't own the stock. Although, I did have it in one of my portfolio's for the CNBC $Million challenge. CVLT helped propel that portfolio into the top 1% for most of the week before finishing Friday in the top 2%. I normally don't enter these type of contest. The reason I entered this one is because it's always been a life long dream of mine to go to the Super Bowl. Week 10 weekly prize is Super Bowl tickets. My other portfolio's for the contest all rank anywhere from the top 12% to the top 2%.

You may also click on the post title to take you to my GarpScan google page. Thanks for stopping by and good luck with your trades.

Labels: decisionmoose, garp stocks, stock scans, Super Bowl

Friday, May 16, 2008

Fill the Gap

I'm watching this gap closely. If this Nasdaq100 Chart happened to be a nearby cotton chart every old- timer cotton trader eyes would be looking to see if the market closes above or below this gap and what kind of volume took place for that trading day. I know you are all saying the $NDX gaps all the time. Well, this one is more significant due to the fact this gap was left the day the $NDX closed below the "all important" 200 day sma. For those who looked at the cotton chart will swear, cotton is headed back to 87 cents.

I'm watching this gap closely. If this Nasdaq100 Chart happened to be a nearby cotton chart every old- timer cotton trader eyes would be looking to see if the market closes above or below this gap and what kind of volume took place for that trading day. I know you are all saying the $NDX gaps all the time. Well, this one is more significant due to the fact this gap was left the day the $NDX closed below the "all important" 200 day sma. For those who looked at the cotton chart will swear, cotton is headed back to 87 cents.Labels: commodities, Nasdaq 100, technical analysis

Thursday, May 15, 2008

We know where resistance is ,"Where's Support?"

Click Here and take a look at that little gap that's about to be visited! I think volume is about to explode. Take a step back and 2 steps forward. Let's see if the gap holds for support, then I'm looking for a breakout above 1440.

Sunday, May 11, 2008

RedDirts Weekly Update

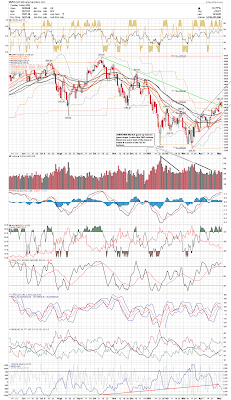

The expected pull back took place this past week although it missed my target by 7 points as the low for the week was 1384.11 instead of the 1377 that I felt would be hit. Here on the Daily Chart it appears some support may be trying to build along the trend line and the 65 day trading band. I'm thinking since the candle for Friday is by no means bullish looking, the market will be headed lower for now.

The expected pull back took place this past week although it missed my target by 7 points as the low for the week was 1384.11 instead of the 1377 that I felt would be hit. Here on the Daily Chart it appears some support may be trying to build along the trend line and the 65 day trading band. I'm thinking since the candle for Friday is by no means bullish looking, the market will be headed lower for now.The past weeks BRIC trade finally saw the $RSX breakout above the gap resistance that I've been mentioning for the past few weekly updates. $RSX was up all five days last week and led the BRIC countries with a 10% gain for the week. It was followed by Brazil(EWZ) with a -0.56% loss. Then came the pain, as China and India fell -7.11% and -8.6%. The EEB remained above the trend line even as we witnessed a stochastic sell signal for the $HKO. My trailing stop will determine how much longer I'll be in this trade.

The GreenTrade stocks had some really big winners for the week, led by BWEN with a gain of 21.86% for the past week. It was followed by AMSC with a 14.41% pop and SOLF with a 13.01% gain. PBW was unchanged for the week and QCLN gained 1.82%.

The Moosignal is to stay in cash for another week. Click HERE to read the latest MooseCall by William Dirlam.

One good thing about every bear market is eventually they come to an end, for now this bear seems to have some bite left in him.

Labels: decisionmoose, growth stocks, RedDirts BRIC Trade, sp500, weekly update

Friday, May 9, 2008

$HKO Stochastic Warning

Stochastic sell signal for the $HKO. The trendline and the gator moving averages for the EEB have not been violated, yet. I'll move up my trailing stop to $51.42 to lock in a profit.

Stochastic sell signal for the $HKO. The trendline and the gator moving averages for the EEB have not been violated, yet. I'll move up my trailing stop to $51.42 to lock in a profit.Labels: BRIC ETF's, RedDirts BRIC Trade

Thursday, May 8, 2008

One to Watch in it's Recovery Phase

Wednesday, May 7, 2008

MidWeek update

Note to self:"the S&P500 closed above the midpoint on the 360 degree trading channel. Does this mean we will retest the old highs by November? Or could it mean the long awaited short covering rally is about to begin and we could retest the old highs much sooner. If Russia and Brazil have been buying the $USD, are commodities going to tank? Why would Golden Slacks be predicting $200/barrel oil unless they were wanting to build a short position? Can a former mortgage trader/hedge fund manager climb 200 feet in the air to work on a wind generator? Can the markets keep the yield curve steep enough for the financial sector to recover? Or, will the FED have to stave off inflation and the long end of the curve go sky high which would deflate housing prices even further? Is the Savings&Loan crisis left by Ronald "De-Regulation" Reagan, starting to look like a drop in the bucket to the problems we face now? Things are sure starting to feel like the '70's and '80's. I think I'll continue to focus on my short term trade indicators.

Note to self:"the S&P500 closed above the midpoint on the 360 degree trading channel. Does this mean we will retest the old highs by November? Or could it mean the long awaited short covering rally is about to begin and we could retest the old highs much sooner. If Russia and Brazil have been buying the $USD, are commodities going to tank? Why would Golden Slacks be predicting $200/barrel oil unless they were wanting to build a short position? Can a former mortgage trader/hedge fund manager climb 200 feet in the air to work on a wind generator? Can the markets keep the yield curve steep enough for the financial sector to recover? Or, will the FED have to stave off inflation and the long end of the curve go sky high which would deflate housing prices even further? Is the Savings&Loan crisis left by Ronald "De-Regulation" Reagan, starting to look like a drop in the bucket to the problems we face now? Things are sure starting to feel like the '70's and '80's. I think I'll continue to focus on my short term trade indicators.Sunday, May 4, 2008

RedDirts Weekly Update

This week I'll start out once again with a look at the SP500 weekly chart. The market appears to have found it's way to the resistance area that I mentioned in my April 20th post. A pull back to the low end of the trading band (1377) would not at all surprise me. Considering the oscillating indicators on the weekly and daily charts are in over bought territory. I think we could see a little push higher to start the week then, like a door being slammed in your face, the party's over for now. I would have to see a breakout above 1440 along with high volume to convince me otherwise.

This week I'll start out once again with a look at the SP500 weekly chart. The market appears to have found it's way to the resistance area that I mentioned in my April 20th post. A pull back to the low end of the trading band (1377) would not at all surprise me. Considering the oscillating indicators on the weekly and daily charts are in over bought territory. I think we could see a little push higher to start the week then, like a door being slammed in your face, the party's over for now. I would have to see a breakout above 1440 along with high volume to convince me otherwise.Now let's take a look at the BricTrade. Since the late March StochRSI buy signal on the BIK and the Stochastic buy signal for the EEB on the $HKO chart, we've seen a nice run up on both charts. Since March 26 the FXI(China) has led the way with a 24.5% gain. Followed by EWZ(Brazil) with a gain of 17.88%. Next would be INP(India) with a run of 12.23%. Last but not least is RSX(Russia) with a gain of 8.58%. As I mentioned in a previous post on April 20th, the RSX drew some attention due to the fact it was in a strong resistance area at that time. This gap resistance has limited the gain for RSX for the past 3 weeks. It now looks to me the technicals have corrected and it will soon make another attempt to break out above the gap resistance area. Does BRIC stop growing just because the USA isn't?

Wow!!! Some of the GreenTrade Stocks have rocketed to the sky lately. BWEN(formerly known as TWRT) is my personal favorite due to the fact I first took a position in this stock because it showed up on my Flat Base Breakout (FBB) scan. This was even before Jeffrey Gendell bought in. Now talk about a boost in your confidence for holding a trade. Seeing a GURU jump on board doesn't hurt.

For the latest MooseCall click HERE and hit the refresh button on your browser.

Labels: BRIC ETF's, decisionmoose, green trade, sp500

Friday, May 2, 2008

GARP SCAN

Subscribe to Posts [Atom]